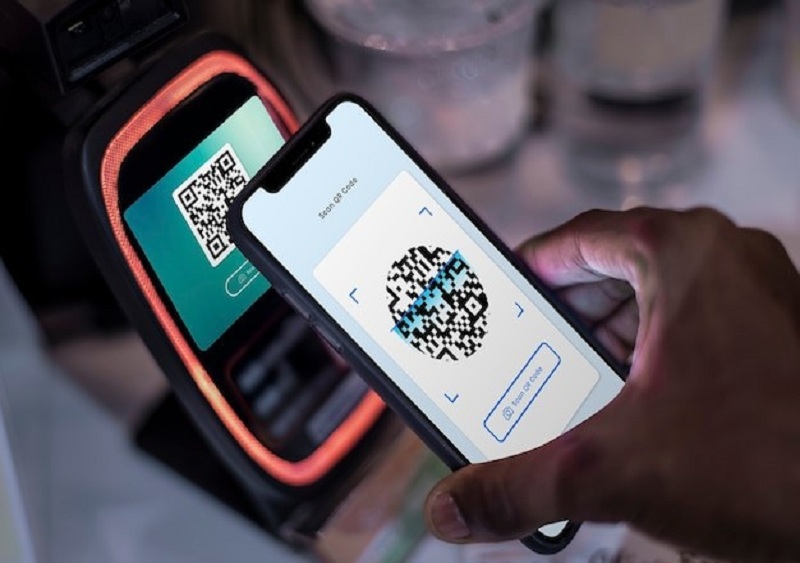

The digital age has brought with it a major shift in the way we transact payments. One of the most significant changes that digital technology has brought is the emergence of digital wallets as a revolutionary payment method. A digital wallet, or e-wallet, is a type of software-based system that securely stores users’ payment information and enables them to make payments online or in-store using mobile devices, including smartphones and tablets. With the rise of digital wallets, the traditional cash-based payment system is slowly becoming obsolete.

Wallet apps like PhonePe, Paytm, GooglePay, and Bajaj Finserv have become household names in India and are used extensively for online wallet payment. These wallet apps have revolutionized the way we use our money, making it a much more convenient and efficient method of payment. Using your digital wallet, you can securely store your payment information, add funds to your account, and make transactions with ease. These apps have made it really simple to make secure transactions in seconds.

Apart from the convenience factor, digital wallets have numerous other benefits, such as safety and security. Users no longer have to worry about carrying large amounts of cash or multiple payment cards as all the payment information is stored on their mobile device. These apps use sophisticated encryption techniques, making it nearly impossible for anyone to steal sensitive data. Furthermore, digital wallets offer 24/7 transaction monitoring, reducing the possibility of fraudulent transactions.

One of the most significant advantages of digital wallets is that they are versatile. They can be used for a wide range of services, such as bill payments, online shopping, and even for making donations. Digital wallets have made it possible for people from remote areas to have access to financial services, which was not possible before. In recent years, digital wallets have become so advanced that users can even make international transactions, making cross-border payments much more accessible.

Let us compare some of the popular digital wallet apps in India –

Paytm – Launched in 2010, Paytm is the most popular digital wallet app in India. It has over 350 million users and allows them to make payments, transfer money, book movie and flight tickets, and recharge mobile phones. Paytm also allows users to invest in mutual funds and buy gold electronically. Paytm was initially started as a bill payment and mobile recharge app, but it has now grown into a full-fledged digital wallet. It offers one of the best payment processing experiences, with fast processing times and real-time monitoring. Paytm also offers cashback and reward programs, making it a favorite among users.

PhonePe – Launched in 2016, PhonePe is a popular digital wallet app that provides quick and secure wallet payment options. It was introduced as a UPI-based payment platform, which revolutionized the way digital payments were made in India. PhonePe allows users to make payments, transfer money, book movie and flight tickets, and recharge mobile phones. PhonePe also offers a credit line, which can be used for bill payments, recharges, and other transactions. Apart from this, PhonePe employees robust security measures that make it one of the most preferred digital wallet platforms.

GooglePay – GooglePay, a product of Google, was launched in 2017 and quickly became one of the most trusted digital wallet apps in India. GooglePay offers a seamless payment experience, with fast processing times and real-time monitoring. Unlike other wallet apps, GooglePay does not require a separate account to be created; instead, it offers simple integration with users’ existing bank accounts. GooglePay also offers cashback and reward programs, making it a favorite among users. GooglePay also offers safe transactions with sophisticated encryption technology.

Bajaj Finserv – Bajaj Finserv is a non-banking financial company that provides a user-friendly digital wallet to its customers. Using this wallet, customers can easily pay their monthly utility bills such as electricity, LPG, Broadband etc. seamlessly. Customers can also earn rewards such as cashback and Bajaj Coins on transacting using the Bajaj Pay Wallet.

Comparative Analysis

Each wallet app has its own unique features and advantages. The comparative analysis below provides a detailed overview of the distinctive characteristics of each.

Visually, Paytm is very user-friendly and easy to navigate. It also has an exhaustive list of payment options, making it suitable for users who need access to a large range of payment options. Paytm also offers the option to make payments without an internet connection, which can be especially useful for people living in rural areas with limited internet connectivity.

PhonePe, on the other hand, offers a very clean user interface, making it easy for users to surf through the app. Its UPI-based payment system has made it fast, reliable, and secure. It is also one of the most preferred payment apps, with quick processing times and tight security measures.

GooglePay, just like PhonePe, offers a clean interface design with fast and secure transactions. Its biggest advantage is ease of use, GooglePay is easy to integrate into your existing Google account, eliminating the need for creating an additional account. GooglePay also offers real-time transaction monitoring which provides excellent transaction safety.

Bajaj Finserv, unlike other wallet apps, alsooffers personal loans, which is a great option for people who require a large amount of funds for a particular purpose. The company offers a wide range of flexible options in terms of interest rates, tenure, and EMI plans to suit the needs of its diverse customer base. Additionally, one can get personalised offers pertaining to insurance, investment and credit cards.

In conclusion, digital wallets have brought a revolution in payment methods, and the traditional cash-based payment system is quickly becoming obsolete. Digital wallet apps like PhonePe, Paytm, GooglePay and Bajaj Finserv have made it easy, seamless, and secure to conduct transactions. It is important to note that each wallet app has its own unique benefits suited for different types of users. So, users must choose the pricing that suits them best, based on their specific preferences and requirements.